Advertisement

Concrete Analysis | China’s REITs need tax breaks to rouse a Rocky-like comeback, catch Singapore and Japan

- China unveils a pilot programme for real estate investment trusts (REITs) with a narrow scope and criteria

- A successful REIT market in China could dwarf all Asian markets in Singapore, Hong Kong and Japan, says David Ellis, a partner at law firm Mayer Brown

Reading Time:3 minutes

Why you can trust SCMP

In the late 2000s, it looked as if China REITs (real estate investment trusts), would have a coherent legal framework and thereafter become the dominant Asian REIT market. It never happened, floored by a tax impasse and concerns about market bubbles.

They may be set to pick themselves off the canvas, like Sylvester Stallone’s Rocky Balboa in the Rocky movies, and get back into the game.

A joint statement on April 30 by the China Securities Regulatory Commission (CSRC) and the National Development and Reform Commission (NDRC) about a new pilot for C-REITs provoked much interest.

Advertisement

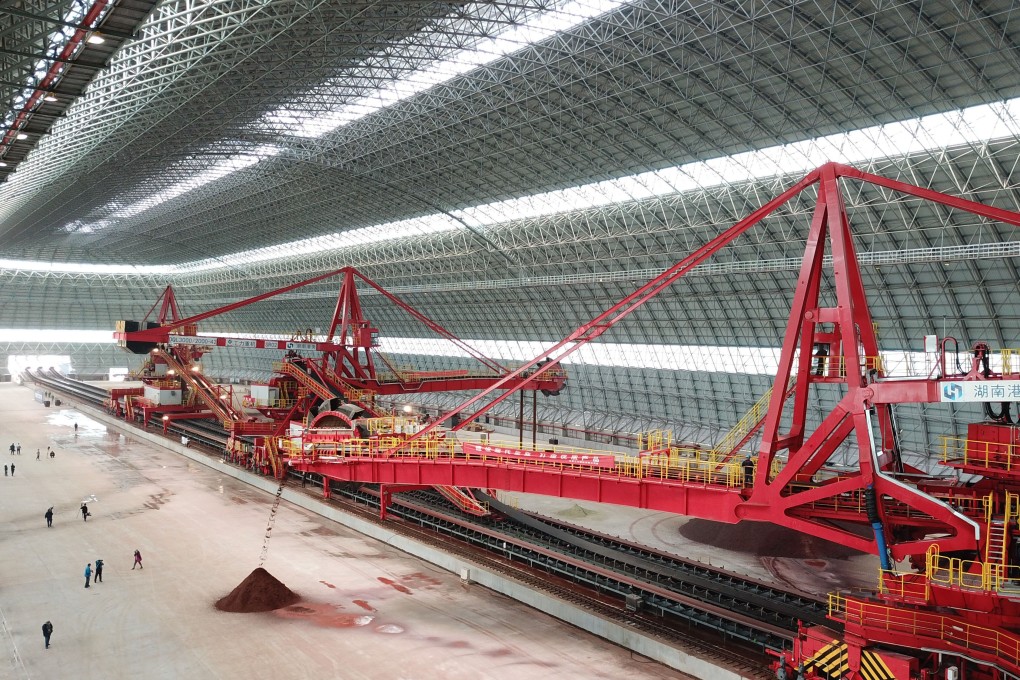

These new C-REITs, however, are narrow in scope. They are only permitted to finance infrastructure projects which have been in operation for at least three years. Neither the joint statement nor a separate CSRC circular on the same day provide details of how the new vehicles will obtain tax neutrality, without which it is hard to see how they will become popular.

Investors have been yield-hungry, with interest rates on government bonds hugging the floor or sinking below it under the weight of policy measures to counter the global economic crisis.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x