Jake's View | Does an inverted yield curve spell trouble for US economy?

A discrepancy in interest rates for short and long-term debt instruments have in the past foretold recession and an impending collapse of the US stock market

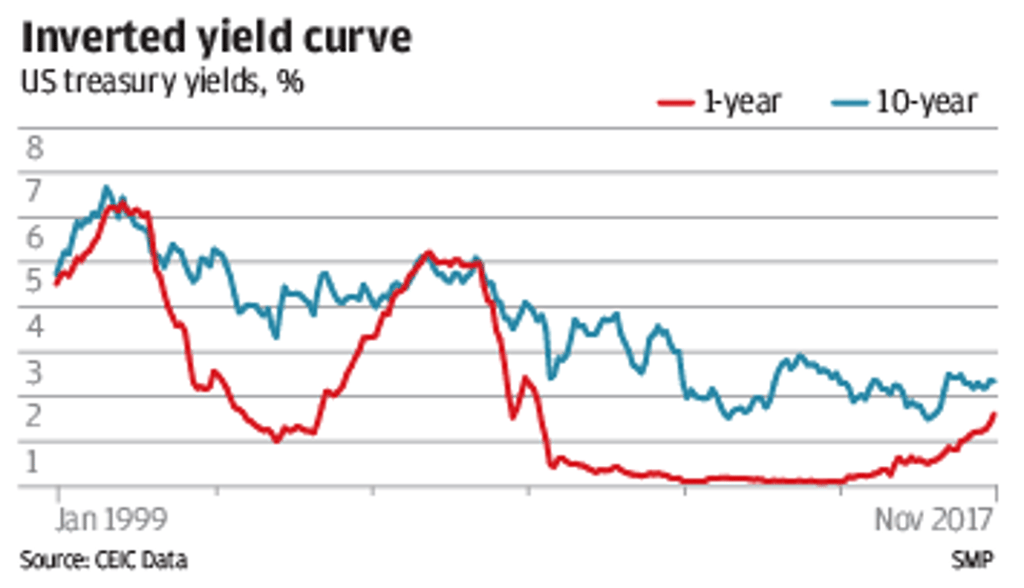

Here is an indicator of trouble to keep your eye on if present trends continue. It is called an inverted yield curve and in the past it has always spoken prophecy.

For this we have to go to the financial marketplace in the United States. It is the only one liquid enough for this curve of fate to show itself reliably. I have to exclude those markets taken to Never Never Land by monetary sorcery at the European Central Bank and the Bank of Japan.

The idea here is that short-duration debt instruments in normal times trade at lower interest rates (or yields) than long- duration ones do. You normally get a higher rate for

10-year than for three-month debt. It stands to reason. More can go wrong for you over 10 years than over three months.

But every now and then the whole picture goes awry and the difference between short-term and long-term rates narrows, eventually even reaching the point where short-term rates are higher.

What you see here are two classic examples of an inverted yield curve, one in early 2000 and one lasting from mid-2006 to mid-2007. Each of them accurately foretold recession and an impending collapse of the US stock market.