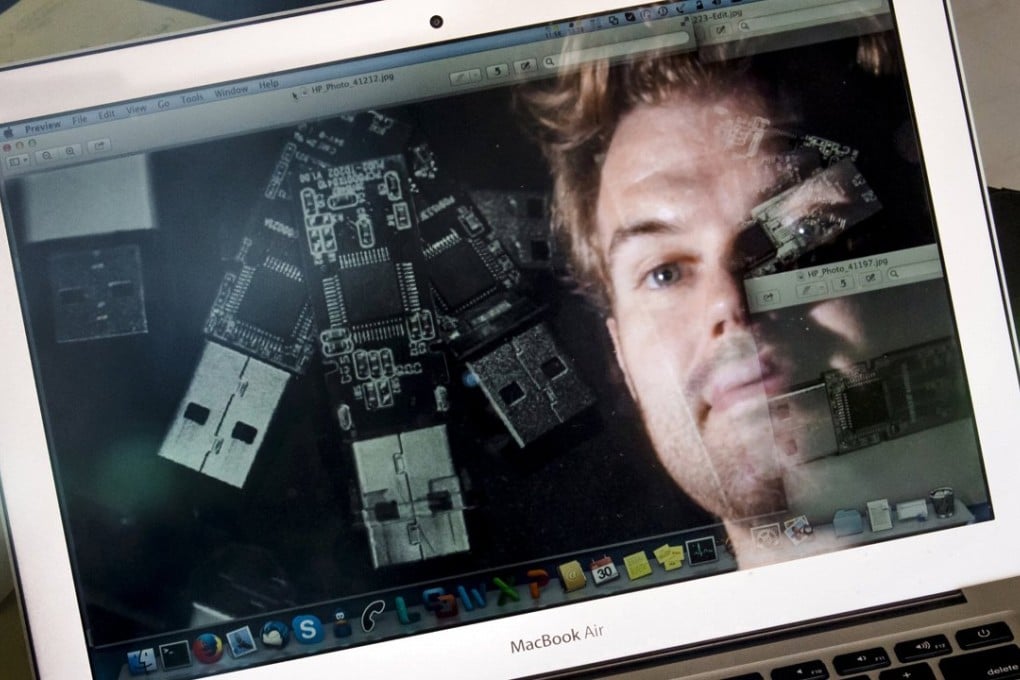

Managers need to take cybersecurity seriously

Only 9 per cent run penetration tests to check their systems on a regular basis

No matter what your industry, cyber security needs to be top of mind for management teams. These days, with organised cyber criminals running mass-scale hacking operations and then selling information about institutional vulnerabilities, companies need to be proactive in their defence.

A worldwide survey of more than 900 executives conducted by Accenture Strategy found that more than two-thirds of respondents believe the likelihood of a cyberattack to be “very” or “extremely” high and a similar share sees a high likelihood of data or privacy breaches. With that in mind, it’s somewhat surprising that only 9 per cent run inward-directed attacks (penetration tests) to check their systems on a regular basis. It’s clear there is a significant disconnect between how aware organisations are of the cyber-threat and how prepared they are for such an attack.

Managers need to address this disconnect by making cyber security a top-down priority. From the board of directors and senior managers to junior analysts, your team needs to take cyber security seriously.

A 2015 study conducted by Accenture and Ponemon Institute found that firms that displayed leadership in cyber security shared certain characteristics, including immediate reporting of security incidents to the chief executive and board of directors, clear definition of security responsibilities and authority, and effective communication of security requirements to all employees. In short a company’s leadership team needs to address cyber security head on.

READ MORE: Cybersecurity Threat: Investment Bank Challenge

Many companies are already using new security technologies that enable them to identify anomalies in network traffic, prioritise threats and provide advance warnings of possible breaches. In addition, some companies have begun exploring new technologies to identify and prevent cyber incursions. For example, in financial services pioneering retail banks in some countries are using biometric authentication at automated teller machines, while some investment banks are piloting voice biometrics for added security and a better customer experience during telephone transactions.

Others are exploring new authentication methods, such as social log-ins and risk- or content-based identification. Although still in very early stages, such services might result in a competitive advantage, especially given the negative media exposure that is generated by successful cyber-attacks.