Advertisement

Advertisement

Stephen Roach

Stephen S. Roach, a faculty member at Yale University and former chairman of Morgan Stanley Asia, is the author of Unbalanced: The Codependency of America and China.

A system which emphasises stability and control will face challenges in uncovering the DNA of the Chinese consumer.

Not only is China unwilling to admit the severity of its downturn, many Asian officials believe Trump’s tariff pledges are a bluff.

While Trump’s rhetoric and policy sometimes diverge, this time around there may be more reason to take him literally.

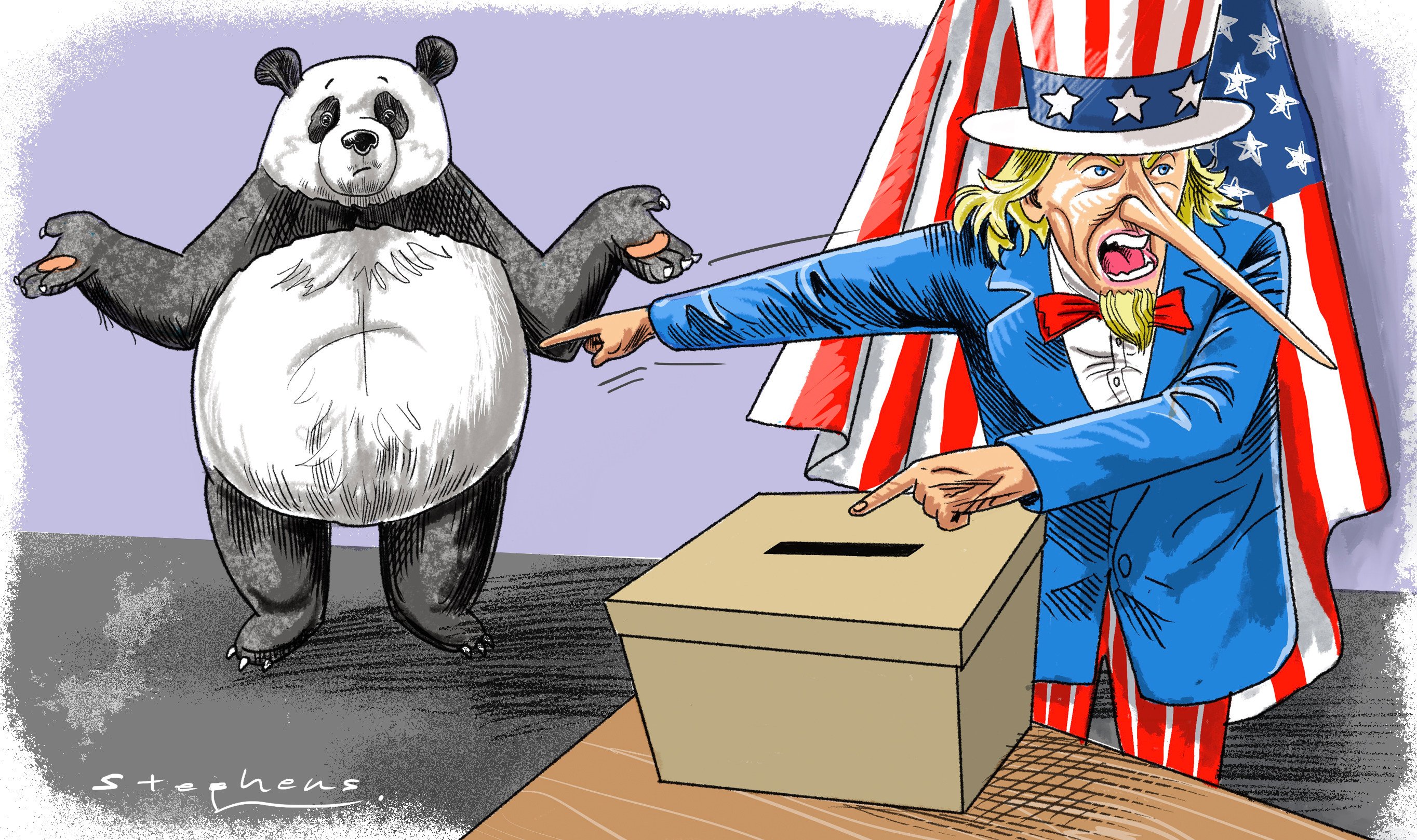

Amid false narratives and lies, the world’s most important bilateral relationship is destabilised and serious policy blunders are made.

Advertisement

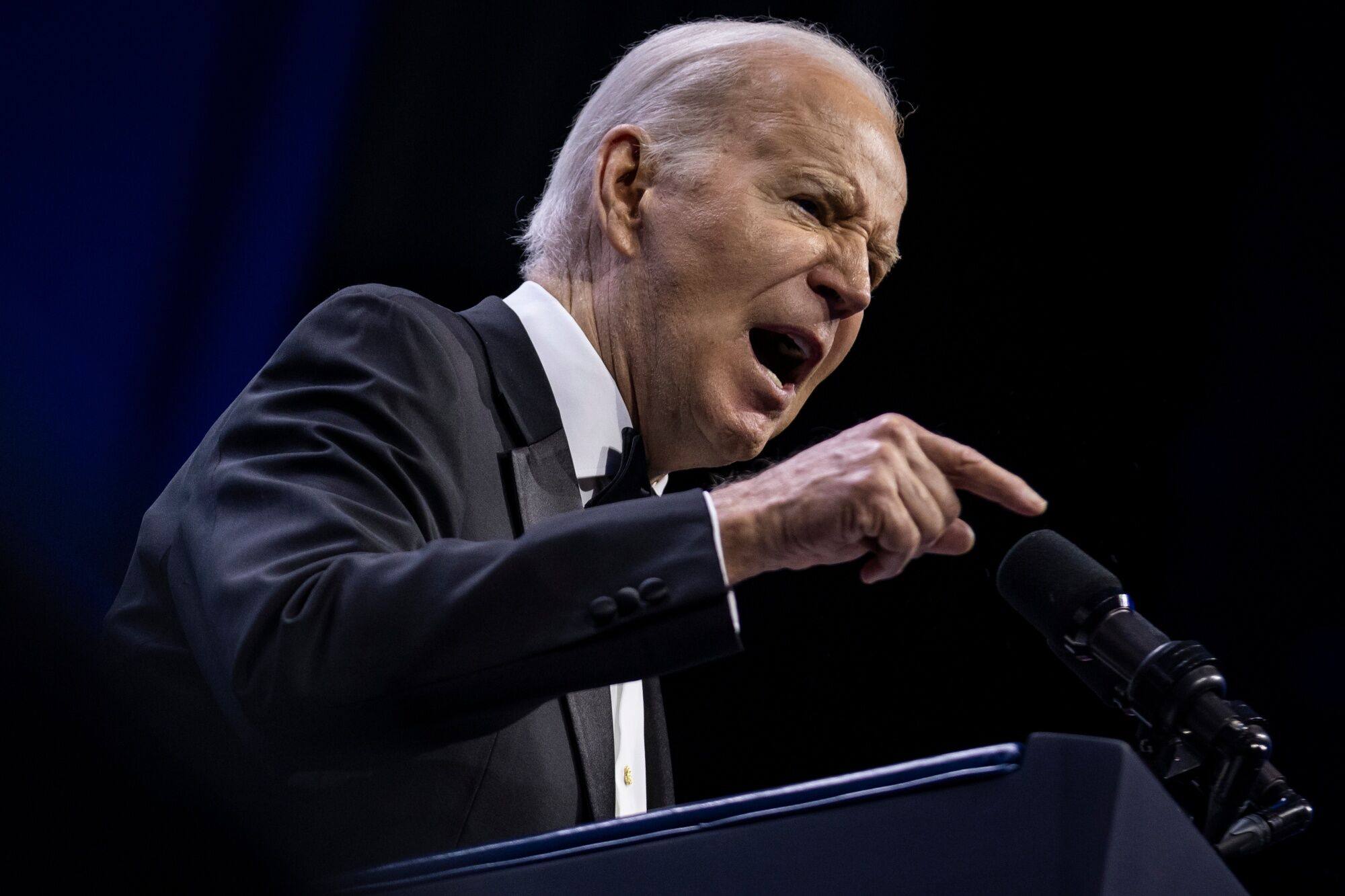

It is worrying that candidates and voters have little interest in probing the US’ most consequential foreign policy issue of the century.

Vice-presidential nominee Tim Walz’s views on China raise the chances of a badly needed Nixon-like initiative by a Harris administration.

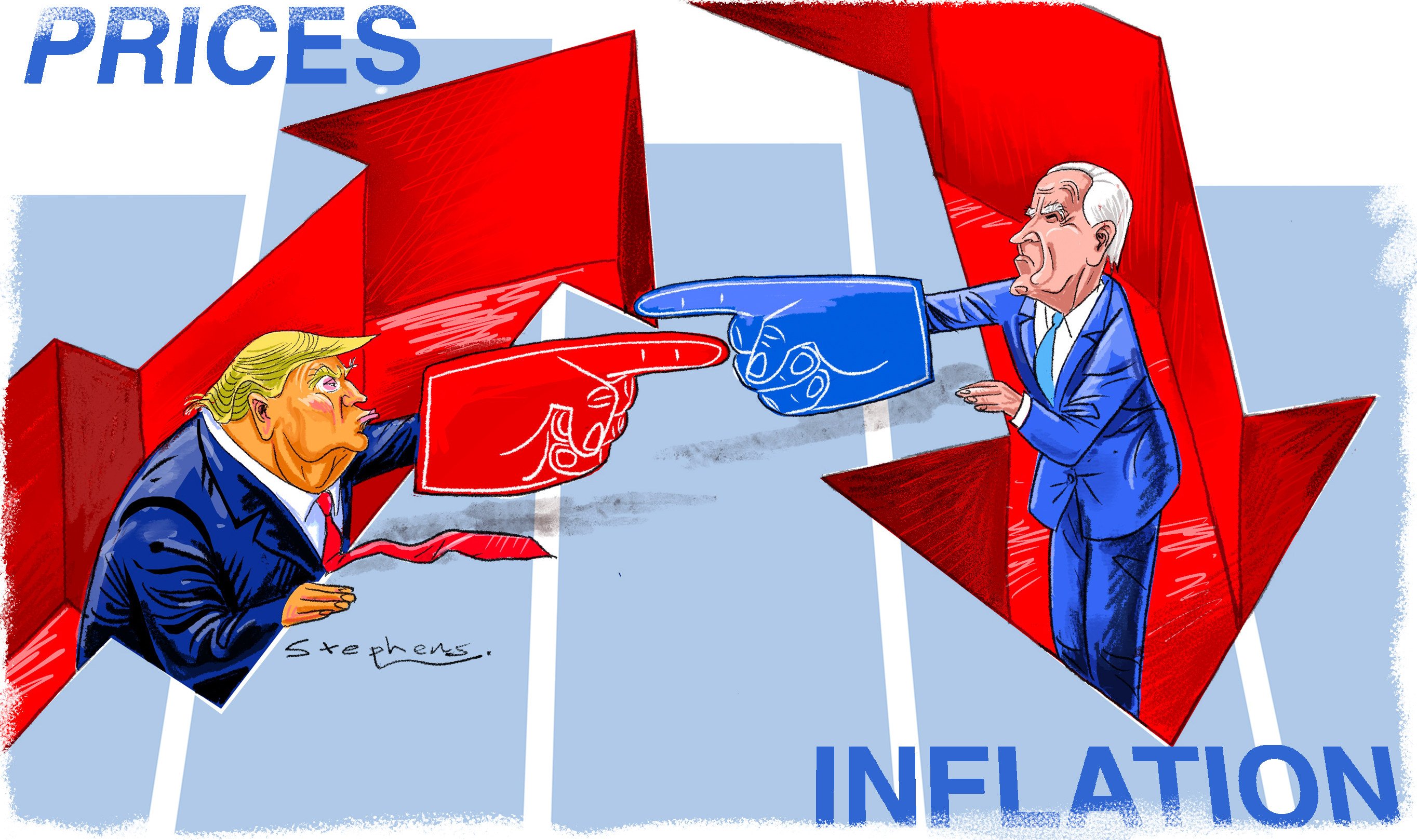

High prices weigh more on US voters’ minds than falling inflation, but don’t expect either major candidate to offer more than finger-pointing.

US political leaders have resorted to playing the blame game to convince voters they are fixing the country’s trade deficit. But by going after China, they are ignoring the root of the problem – the federal government’s unchecked spending – while increasing the risk of a full-blown superpower conflict.

Myths and exaggerated claims about China are pervasive in American political discourse, with growing fears about technology and trade. Instead of reflecting on how to improve as a country, US politicians blame China for political expediency but risk inciting accidental conflict

Even with the city’s famed Phoenix-like ability to rise from setbacks, it may be beyond Hong Kong to overcome the triple whammy of a loss of its high degree of political autonomy, the protracted malaise of the mainland economy, and the US-China power struggle. This sobering view should serve as a wake-up call.

It is time to stop viewing crises as exceptional events and admit how frequently shocks actually occur. The task of forecasters and policymakers is not to predict the next catastrophe but to sharpen their focus on resilience – what it takes to stay the course with politically mandated policies while minimising inevitable dislocations.

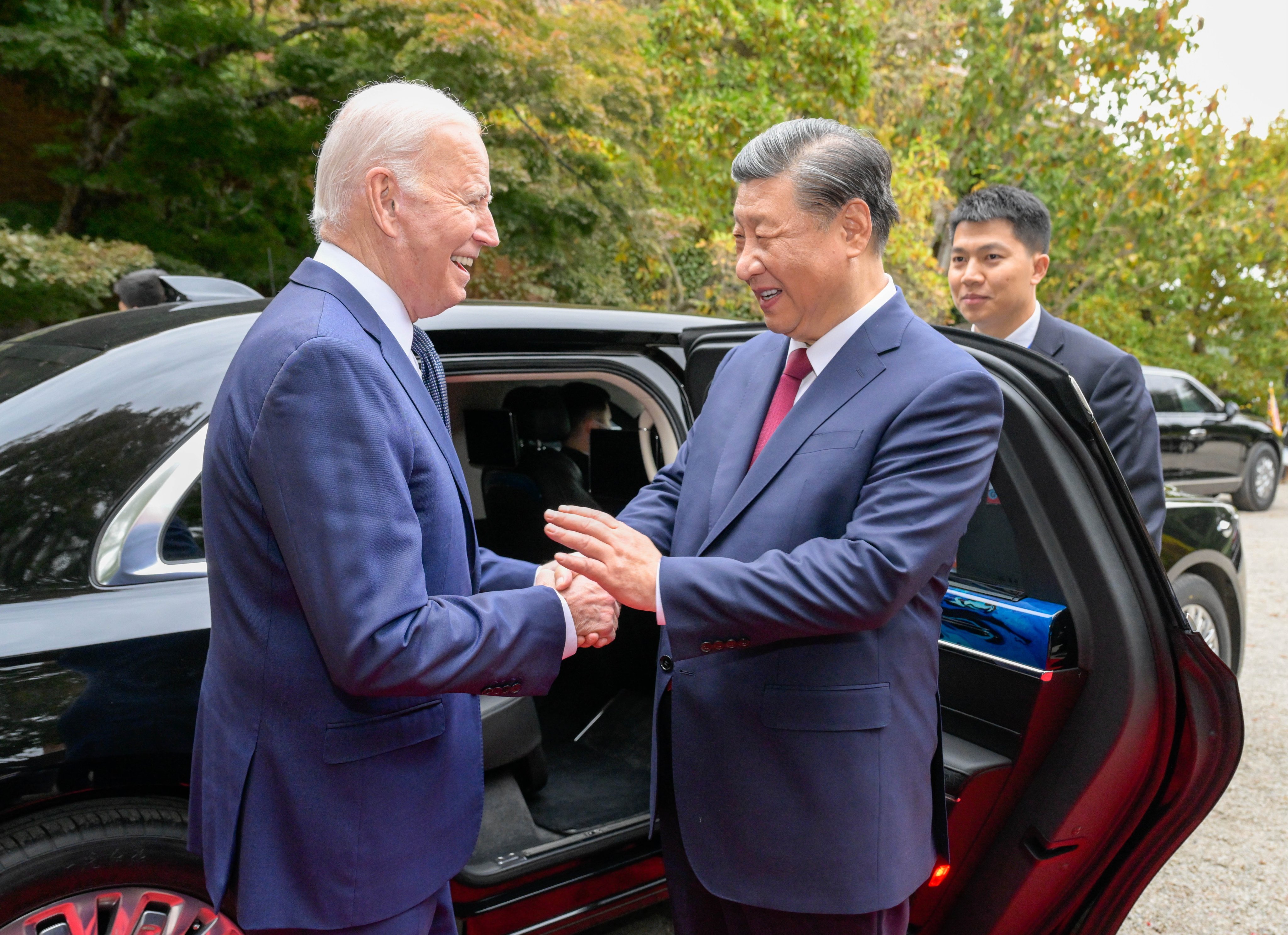

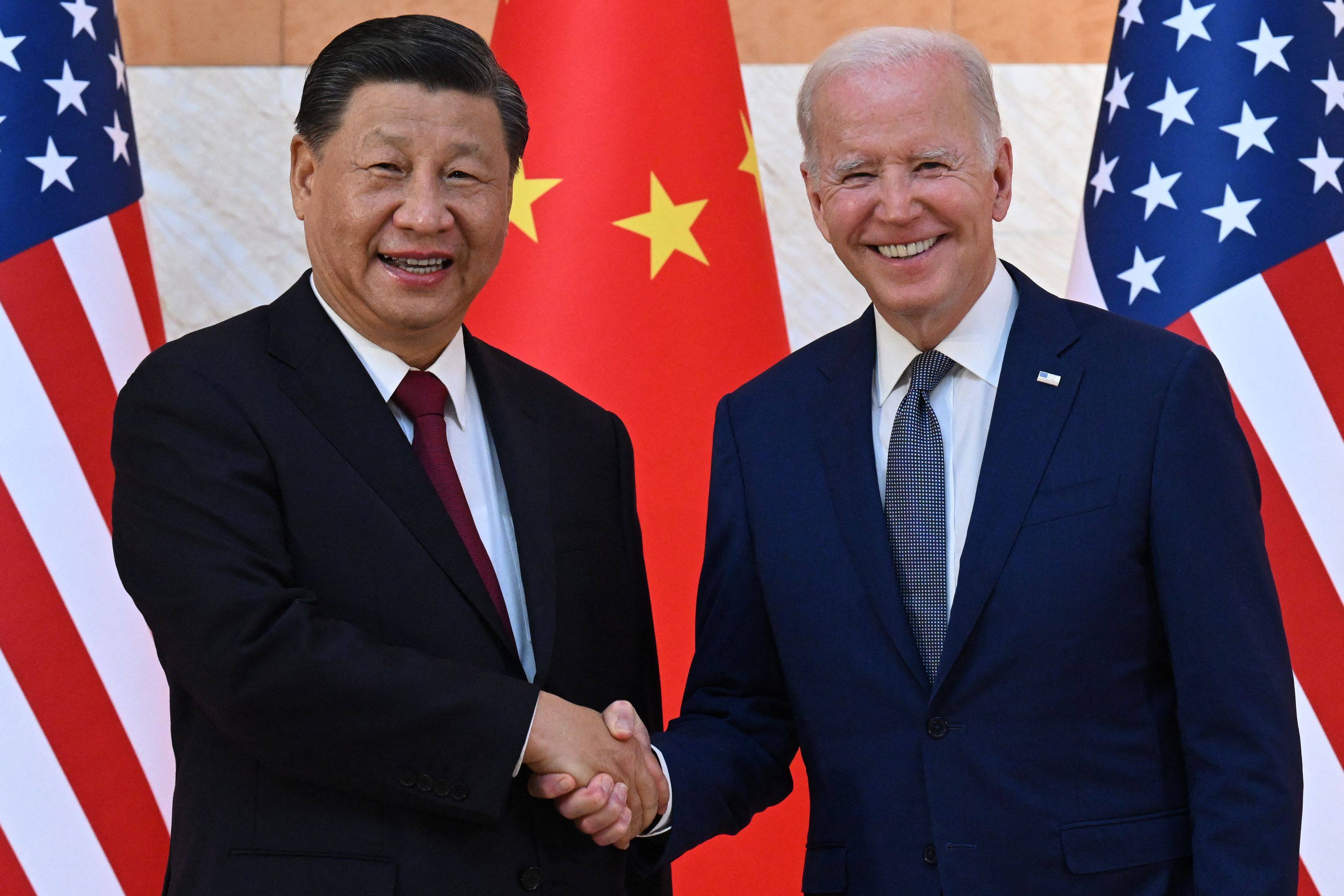

The latest summit was an improvement on last year’s meeting, in that it made progress on US-China military-to-military communications. However, deep questions remain about the contours of the Sino-American conflict, especially concerning the economic, trade and technology issues that precipitated it.

Despite the dismal state of bilateral ties, a Xi-Biden summit should aim to agree on some realistic deliverables, underscore aspirational goals, and lay the foundations for a new institutional framework for engagement.

Strategic thinking requires a focus on the longer term and is largely absent in US policies today. Yet, US tactics such as tariffs and sanctions have not stopped Huawei from developing its breakthrough new phone.

An overly indebted economy means China cannot afford to roll out a massive stimulus and is facing a much slower growth trajectory. Beijing’s consumer-led rebalancing makes no mention of strengthening the social safety net, vital to avoid continued fear-driven precautionary saving.

Targeting China won’t solve the US trade deficit, which ballooned because of its own macroeconomic woes. And arguing for ‘de-risking’ instead of decoupling makes no difference to the deleterious effects.

The meagre results and political context around Antony Blinken’s trip to Beijing showed the shortcomings of a personalised approach to diplomacy. Shifting to a more institutionalised model of engagement would take conflict resolution out of the hands of highly sensitive, politically constrained leaders.

A few years ago, China appeared well placed to threaten the US’ technological lead, but the advent of large language models is a game-changer. New draft rules covering chatbots, on top of the existing censorship regime, will constrain the ability of China’s tech companies to develop generative AI.

Janet Yellen was right to frame prioritising national security concerns over economic ones as a trade-off, but she only hinted at the possible consequences. Compromising trade and capital flows from China and elsewhere could result in slower economic growth, higher inflation and a weaker US dollar.

The string of bank collapses in the US due to a lack of Fed supervision feeds directly into Beijing’s narrative that America’s power is declining.

Then, as now, global powers hyped up their own narratives instead of communicating, creating an environment in which any unexpected event might spark conflict. And, like today, people doubted that war could break out in a globalised, interconnected world.

China continues to play a long game, whereas the US tactical assault on Chinese technology is all about short-term gains. As long as the US is trapped in a political system that places little value on strategy, there is no guarantee it will prevail in an existential tech conflict.

With a shrinking working-age population, China needs an acceleration in productivity growth to reclaim its mantle as the world’s greatest growth story, but the Chinese leader has not delivered on the promise of a rebalanced economy.

Establishing a permanent secretariat to share information and tackle common issues would build trust and elevate the bilateral relationship to the importance it deserves.

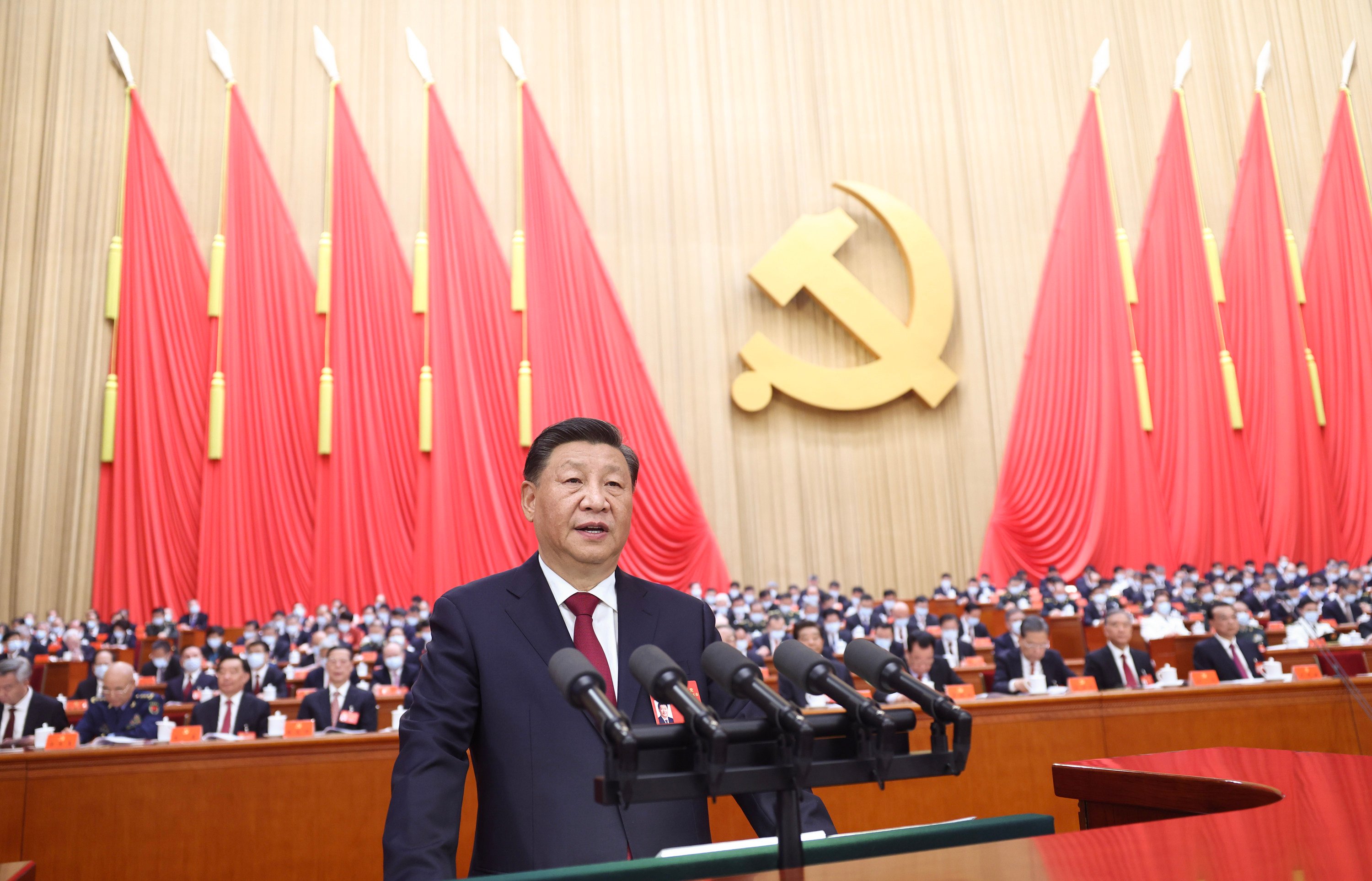

It is unsurprising that Xi Jinping chose loyalists to surround him in the Politburo Standing Committee, but the elevation of ideology tsar Wang Huning bears watching. In terms of strategy, it is clear national security will continue to take precedence over economic growth, especially with regard to conflict with the US.

Just as a fixation on core inflation can mislead central banks, the power of a ‘core leader’ is a recipe for misdirected and ultimately unsustainable policy. The very notion of a core adds a false sense of precision when policymakers attempt to address complex problems.

China’s slowdown is being driven by a structural transformation of the economy, payback for past excesses and a shift in the ideological underpinnings of governance. Xi Jinping is prepared to forgo growth to cement political power and pursue his dream of national rejuvenation.

Globalisation’s defences are crumbling in a world beset by climate change, pandemics and the war in Ukraine. Mounting geostrategic tensions are the wild card, with ‘friend-shoring’ efforts and scrutiny of Sino-Russian ties raising the stakes for China.

The IMF’s latest global outlook projects a soft landing for the world economy, but there are reasons to be sceptical. Headwinds include increasingly sluggish Chinese growth, overlooked consequences of rising interest rates and inflation and overly optimistic forecasts.

Putin’s war against Ukraine has turned China’s triangulation gambit – joining with Russia to corner the United States – on its head. Not only will continuing to support Russia result in sanctions that thwart China’s economic development goals, but it also risks Xi’s own place in history.