HKEX plans to adopt digital currencies and tokenisation in the next decade, which analysts say are in demand for round-the-clock trading.

Derek Lai says firms are more willing to engage professionals to address their debt problems, increasing the chance of a successful result.

MPFA chairwoman Ayesha Macpherson Lau says digital system boosts returns as assets rise to US$196.5 billion.

Move from Bermuda ‘reflects our deep-rooted belief in Hong Kong’s future and its importance to our business,’ Hong Kong and Macau CEO says.

Think tank urges the expansion of connect schemes to cover a wider range of asset classes and the promotion of digital asset trading.

Savings rates near zero limit room for cuts as lenders protect profitability margins, analysts say.

Doubling of voluntary contributions reflects retirement scheme’s importance to local residents, MPFA chairwoman says.

As Hong Kong rapidly ages, more are buying insurance and pension products, while others are heading to the mainland for medical treatment.

Insurance Authority confirms 12,000 policies impacted, with payouts spanning life, medical, property and accident coverage.

Strong competition from non-bank players in mainland market forces banks to improve continuously, consulting firm Sia says.

Residents of Wang Fuk Court hold 7,600 active life and 1,100 property policies provided by some 30 insurers, Insurance Authority CEO says.

3 Dec 2025 - 8:25PM videocam

Appointment surprises market after HSBC CEO Georges Elhedery earlier said the 75-year-old was not keen on a permanent role.

Hong Kong’s rise as a fintech hub is due to the concerted regulatory push, with the city competing with Singapore for regional leadership.

30 Nov 2025 - 4:44PM videocam

The Hong Kong Bar Association is providing free legal services to victims and urges them to take immediate action to protect their rights.

27 Nov 2025 - 11:17PM videocam

Developers defer sales of a total of 213 units in Yau Tong and Yau Ma Tei scheduled for Friday.

Financial secretary calls on UK enterprises and professionals to seize opportunities in Hong Kong’s burgeoning finance and I&T sectors.

Only 36 per cent of respondents in Hong Kong want to lose weight, below the global average of 46 per cent, according to the Cigna survey.

24 Nov 2025 - 11:00AM videocam

Chairmen and CEOs join regulators and financiers in The Community Chest HKEX Gong Run to raise US$1.2 million.

More family offices in Asia, Europe and Middle East see city’s value as link to mainland investments, founder of Swiss firm Club Estate says.

16 Nov 2025 - 9:40AM videocam

The CEO of the Securities and Futures Commission will stay on for at least two more years to see through a series of ongoing reforms.

The nine-month return surpasses last year’s record of HK$239.1 billion and exceeds the full-year high of HK$264 billion reached in 2017.

The Shenzhen-based company plans to use the listing proceeds for R&D and improve its global sales network and supply chain capabilities.

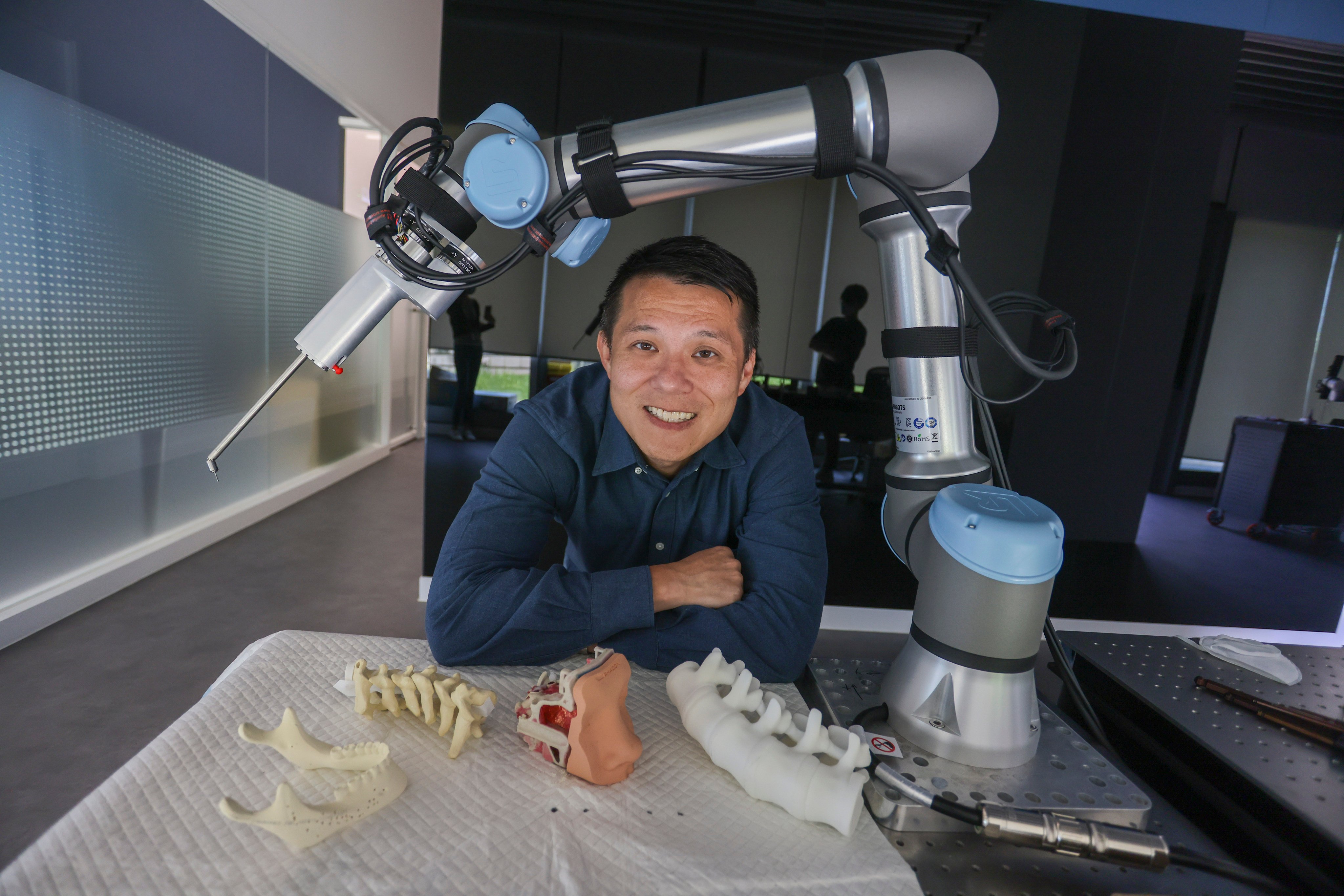

Cornerstone Robotics receives US$200 million injection from Hong Kong government’s investment arm and major venture capital firms.

‘There are a lot of cash deposits held by people in China that will find their way into the markets,’ Andrew Schlossberg says.

Strong response to sovereign notes signals renewed global investor confidence amid de-escalation, open policies, HSBC banker says.

Nearly 45 per cent of top global private banks say their affluent clients prefer Hong Kong over other wealth management centres: PWMA report.

The launch marks the first project under the HKMA’s Fintech 2030 strategy, aimed at introducing tokenisation products in the city.

Third-quarter profit jumps 56 per cent from a year earlier to HK$4.9 billion (US$628 million), beating analysts’ estimate of HK$4.7 billion.

International investors will continue to be interested in China, Goldman Sachs CEO says at the Global Financial Leaders’ Summit.

Nearly 60 per cent of business students are women – and they are the future fintech innovators and next-gen CEOs, financial secretary says.