Investment opportunities abound amid development

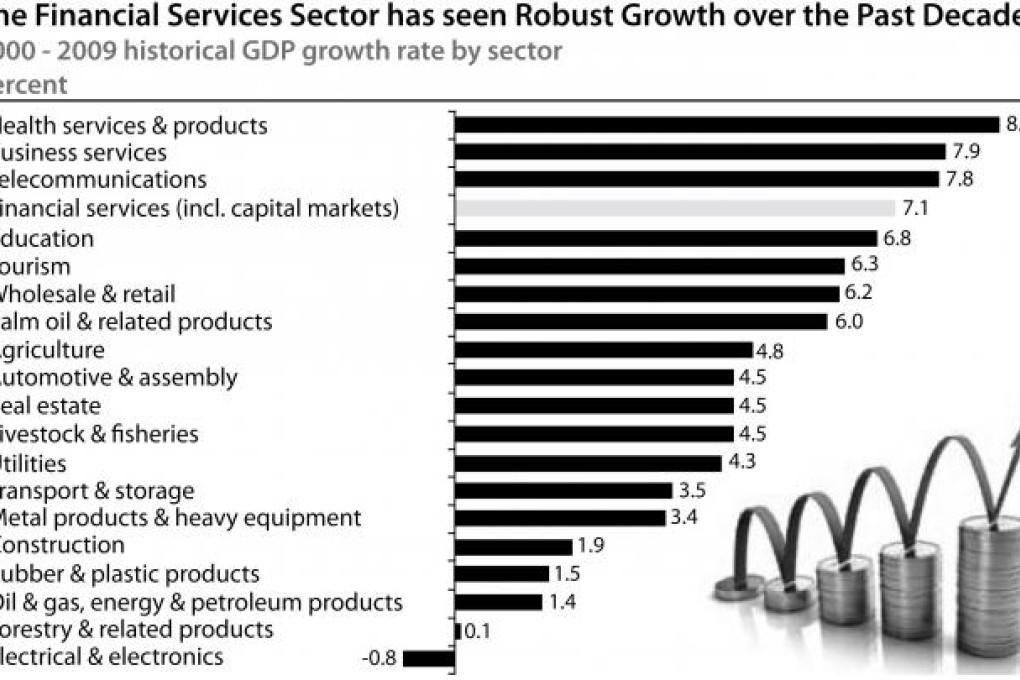

Discovery Reports - Malaysia's Financial Services

With the government's limited investment participation under the ETP, business opportunities abound for the private sector.

The programme has identified six BOs in the financial services sector. The industry requires 145.8 billion ringgit (HK$360.6 billion) in fresh capital, 95 per cent of which is expected to come from the private sector.

"We have interesting areas businesses can look into," says Dr Mohammed Emir Mavani Abdullah, PEMANDU director for oil, gas and energy and financial services. "Foreign companies, for example, can issue their sukuk here while local companies can provide Islamic financing overseas. We can facilitate cross-border mergers and acquisitions (M&As)."

The BOs that investors can look into cover commercial, investment and Islamic banking, insurance and takaful, and asset and wealth management. These opportunities will account for 71.9 billion ringgit in incremental gross national income (GNI) by 2020, creating 229,000 jobs including 100,000 professional and technical positions.

The following are the areas of growth in the financial sector.

BO 1 - Commercial banking